This comprehensive guide explains how a Mega Backdoor Roth Solo 401(k) can significantly boost your retirement savings. We'll cover the mechanics, eligibility, potential pitfalls, and steps to successful implementation. Remember, consulting a financial advisor is crucial before making any decisions.

Understanding the Mega Backdoor Roth Solo 401(k)

The Mega Backdoor Roth Solo 401(k) is a powerful retirement savings strategy leveraging a loophole in the tax code. It allows high-income earners to contribute substantially more to their retirement accounts than traditional methods permit. But how does it work?

How it Works: A Two-Step Process

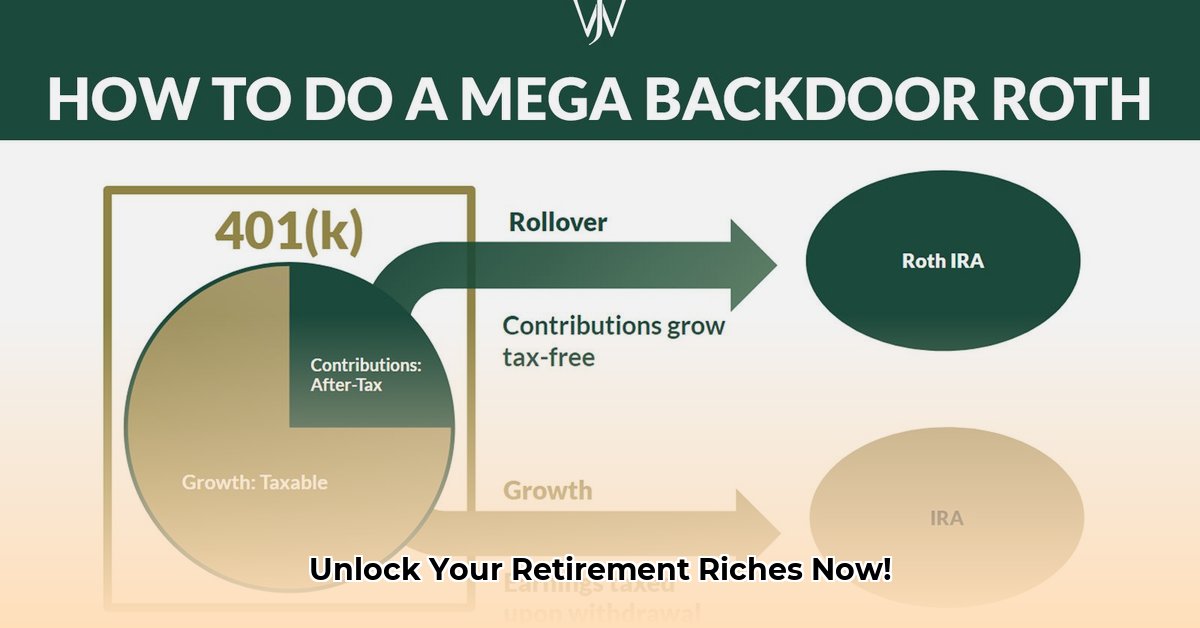

After-Tax Contributions: You contribute to your solo 401(k) after taxes are deducted from your income. This initial contribution isn't tax-deductible.

Roth Conversion: These after-tax contributions are then converted to Roth funds within your 401(k) plan. This conversion is tax-free, meaning you won't pay taxes on withdrawals in retirement (provided you meet certain criteria). This is the key to the strategy's power.

Think of it like this: You pay taxes upfront but avoid paying them again upon withdrawal, potentially saving a significant amount in the long run. This is particularly beneficial if you anticipate being in a higher tax bracket during retirement.

Who Should Consider a Mega Backdoor Roth Solo 401(k)?

This strategy is particularly advantageous for high-income earners who have already maxed out contributions to their traditional 401(k)s and Roth IRAs. The Mega Backdoor Roth provides a significant avenue for additional tax-advantaged savings.

Example: Let's say you're a high-income earner contributing the maximum to your traditional 401(k) and Roth IRA. The Mega Backdoor Roth allows you to contribute significantly more, exponentially increasing your retirement savings.

Contribution Limits: Navigating the Rules

IRS contribution limits change annually, so always refer to the official IRS website for the most current information. Key contribution types include:

- Employee Contributions (Pre-tax or Roth): A fixed annual limit for direct contributions.

- Employer Contributions (Profit Sharing): As a self-employed individual, you can contribute as your own "employer," up to a certain percentage of your income.

- After-Tax Contributions: The core of the Mega Backdoor Roth – additional contributions beyond pre-tax and employer contributions, subject to overall annual limits.

Important Note: Understanding and adhering to these limits is crucial to avoid IRS penalties. Professional guidance is highly recommended.

Setting Up and Maintaining Your Mega Backdoor Roth Solo 401(k)

Implementing this strategy involves careful planning and execution. Here’s a step-by-step guide:

Choose a Provider: Select a solo 401(k) provider that supports after-tax contributions and in-plan Roth conversions. Not all providers offer these features.

Open Your Account: Open a solo 401(k) and establish separate accounts to track pre-tax, after-tax, and Roth contributions for clarity and IRS compliance.

Contribute Strategically: Make contributions throughout the year, meticulously tracking amounts to remain within IRS limits. Accurate record-keeping is essential.

Weighing the Pros and Cons

The Mega Backdoor Roth Solo 401(k) offers significant potential but also presents challenges:

| Pros | Cons |

|---|---|

| Significantly boosts retirement savings | Complex rules and regulations |

| Tax-free growth in retirement | Requires meticulous record-keeping to avoid penalties |

| Potential for very large retirement nest egg | Needs expert help from financial advisor and tax professional |

| More control over retirement savings | May not be suitable for all income levels or financial situations |

Is a Mega Backdoor Roth Solo 401(k) Right for You?

This strategy’s power is undeniable, but it's not for everyone. It's particularly suited for high-income earners who are comfortable with complex financial strategies and understand the need for professional guidance.

Before proceeding: Schedule consultations with a qualified financial advisor and a tax professional. They can evaluate your situation, determine suitability, and explain potential benefits and risks. This isn't a decision to be taken lightly.

How to Avoid Mega Backdoor Roth 401(k) Penalties

While offering immense potential, the Mega Backdoor Roth Solo 401(k) has potential pitfalls. Understanding and adhering to IRS regulations is crucial to avoid penalties.

Eligibility and Plan Design: Essential Considerations

Your employer's 401(k) plan must allow after-tax contributions and in-plan Roth conversions. Confirm eligibility by reviewing plan documents or contacting your plan administrator. Don't proceed without verification.

Nondiscrimination Testing: A Crucial Aspect

The IRS implements nondiscrimination tests to prevent favoring high-income earners. Failure to meet these tests can result in significant penalties. This essentially requires a balance in participation across all income levels within the company.

Steps to Minimize Risk and Maximize Returns

Confirm Eligibility: Thoroughly review your 401(k) plan documents to verify eligibility for after-tax contributions and in-plan Roth conversions.

Understand Contribution Limits: Stay informed about annual limits to avoid exceeding them.

Seek Professional Advice: Consult a qualified financial advisor familiar with Mega Backdoor Roth plans for guidance and compliance.

Monitor Your Plan: Regularly review account statements for accuracy to catch potential errors early.

Stay Informed: Keep abreast of any changes to tax laws and their impact on your plan.

Key Takeaways:

- Mega Backdoor Roth strategies significantly boost retirement savings potential.

- Eligibility depends on your employer's plan features, specifically after-tax contributions and in-plan Roth conversions.

- Understanding and meeting IRS nondiscrimination testing requirements prevents penalties.

- Professional financial guidance is essential for compliance and maximizing benefits.

Remember, this guide provides general information. Consult with qualified professionals before making any financial decisions.